How Do Health Insurance Brokers Help Throughout The Buying Process?

How Do Health Insurance Brokers Help Throughout The Buying Process?

If you’ve ever had to buy health insurance or are in the process of buying it for your small business, you know it’s no walk in the park. There are tons of carriers and plan options, many of which are similar. Plans are described with so many acronyms and so much jargon (HMO/PPO/EPO/POS, deductible, out-of-network, coinsurance, etc.) that you might as well hire a translator to get through it all.

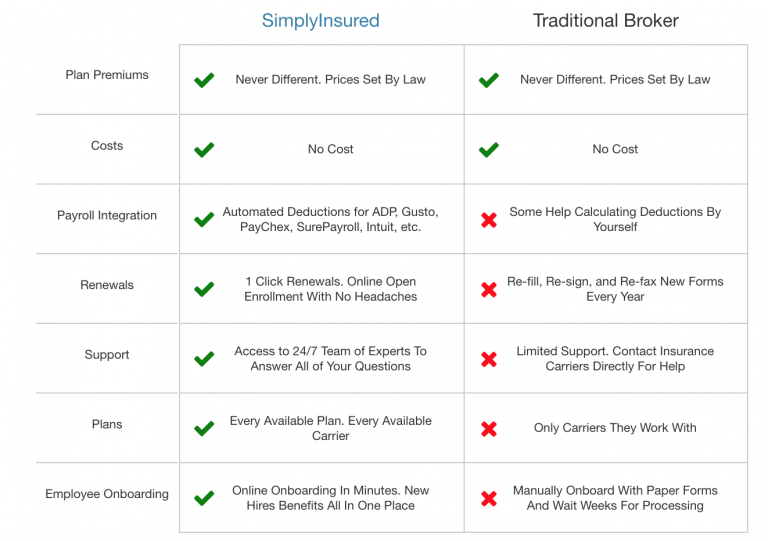

Luckily, there are people whose job it is to help you through the process. Brokers like SimplyInsured can guide you from start to finish without a hitch. Here’s how they help at each stage of the journey:

- Search & Discovery. At this stage, you’re trying to understand how health insurance works and what options exist in your market. Brokers – even ones that are online like SimplyInsured – will ask you what the needs and general health profiles of your employees are, understand constraints like budget, and recommend options that will work for you. They’ll also help you navigate the jargon and give you objective views of the pros and cons of specific carriers and plans in your region. They have an understanding of what plans groups like you have chosen and how things have fared. They can also help you understand which carriers you qualify for coverage with – some states have complicated rules around this, especially for groups under 5 employees. To get the most out of brokers at this stage, ask as many questions as possible.

- Plan Selection. When you’ve narrowed down your choices to just a few, brokers can help you understand the nuances of each plan. They’ll read the fine print and point out subtle differences can potentially save your company and/or your employees thousands of dollars per year. Insurance companies often bury important details of their plans, but solid brokers will highlight them for you and tell you why they’re relevant.

- Application. The application process for health insurance requires several elements, including completing a company form, getting your employees to fill out their own forms, uploading documents like wage reports and articles of incorporation, and setting up automatic payments with the insurance company. In the company form, you’ll need to specify things like cost sharing with employees/dependents, plan start date, and probationary period for new employees. Some of these decisions are daunting, especially for first-time buyers. This is where your broker can help. They can recommend insurance “settings” and can help you identify the documents insurance companies need to approve your application. If you work with a great broker, you can complete your application and have it sent over to the insurance company for processing in hours!

- Underwriting. After your application is submitted, insurance companies take time to review your documents and ensure you qualify. In some cases, they’ll request additional documentation or ask you to sign more forms before you’re officially approved. A solid broker will take time to understand the requests from the carrier, negotiate if possible, and explain things to you as simply as possible.

- Onboarding. Once you’re approved, a broker will help you get started with your insurance. They’ll point you to all available resources (online and offline), help you locate and compare doctors, find the best/cheapest pharmacies, and make sure you get necessary items like insurance ID cards. They’ll help you manage payroll deductions and troubleshoot any initial enrollment issues. You’re paying a lot for insurance, and brokers will make sure you get your money’s worth!

- Administration. You know you have a good broker when you never have to contact the insurance company directly to resolve issues. While you’re running your plan, brokers like SimplyInsured offer tools that help you add and remove employees with one-click, file taxes appropriately, set up HSAs/FSAs, and make sense of complicated invoices. The best brokers never end their relationships with you once you’re enrolled. They’re trusted partners even after the sale.

- Renewal. Your current insurance plan is expiring and you need to evaluate a renewal offer from your current carrier. If you’re not involving your broker at this point, you may be leaving money on the table. The best brokers can weigh your renewal offer against the other options in the market, and help you figure out if you should switch providers or not. They’ll understand what went well and what didn’t go well during the year, note how your business has changed since the first time you bought health insurance, and, if necessary, will find a plan that best suits you moving forward.

Health insurance brokers exist to help, and the best part is that using them is totally free!