How Are Health Insurance Brokers Paid?

How Are Health Insurance Brokers Paid?

If you’re a small employer thinking about using a broker to help guide you through the process of selecting health insurance options for your employees, you’re probably wondering what’s in it for the broker. Have you thought about these questions?

- Is my business going to have to pay an additional cost above the price of health insurance premiums to pay for the broker’s services?

- Will my business receive a bill every month from the broker in addition to the bill I receive from the health insurance company?

- Will my broker try to push me toward a health plan or insurer because that insurer pays the broker more money?

These are all valid questions, and the answer to each one is NO.

Health insurance brokers are paid commissions from health insurance companies. Brokers provide quotes, information about various plans and enrollment assistance to you at no direct cost. The commissions brokers are paid come out of the monthly premium you pay for health insurance. The Affordable Care Act requires that insurance companies spend at least 80 percent of the money received from health insurance premiums on health care costs. The remaining 20 percent can be spent on administrative costs, marketing and other expenses, like broker commissions.

Most insurers pay brokers a set percentage of the premium paid, however some pay a flat fee per policyholder. For example, an insurer might pay a broker $12 per new enrollee, and $8 for each renewal.

Retention is important for brokers. If you have a good rapport with your broker but don’t love the plan you selected for your employees, you don’t have to switch brokers. Health insurance brokers because are paid monthly based on the number of people enrolled in a given plan. They don’t receive a single lump sum payment at the beginning of the plan year. Even if you decide to switch plans, brokers are still paid. However, is you choose to go with a different broker when you move to a new plan, your previous broker will no longer receive commissions.

The amount of commissions that insurers pay brokers is relatively consistent across the board. The cost of health insurance premiums are regulated by the state. Because brokers, for the most part, are paid a percentage of the premium price, the broker has no means to increase the cost of the premium for the sake of earning a higher commission. While brokers do have an incentive to get your employees enrolled in one of the plans it recommends, the commission structure makes it such that brokers are not biased toward one plan. Every employee that enrolls in a plan adds to the amount of the broker’s commission. Typically, broker’s receive higher rate for new policies, and a lower one for renewals.

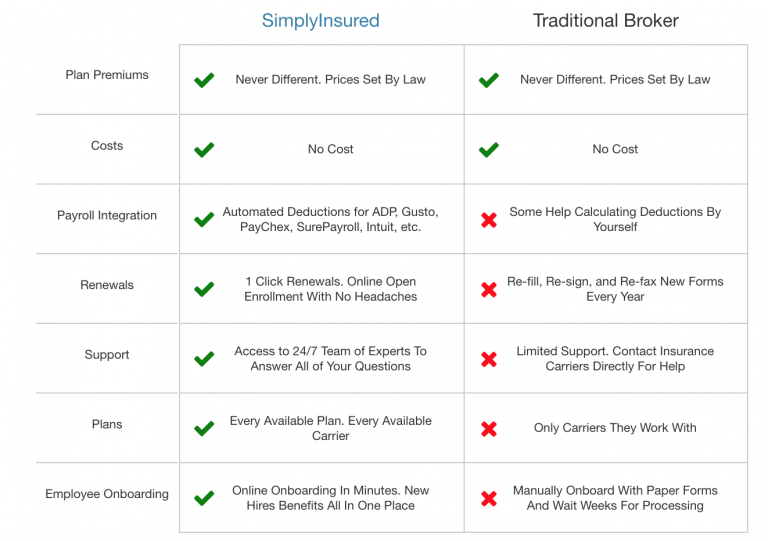

Working with a health insurance broker like SimplyInsured allows you to obtain information about health insurance plans that serve the needs of your business and your employees, without adding an additional line item to your budget. Health insurance brokers alleviate the pressure of researching and navigating the vast health insurance industry, and use their knowledge recommend the best plans for your needs.

Get started today with an instant quote, or contact us at support@simplyinsured.com for additional information.