How to Choose Health Insurance – Startup Edition

So you’ve taken the plunge and started your own company, or joined a startup as an early employee. In addition to the amazing perks of bottomless Red Bull and Top Ramen – you realize you don’t have health insurance anymore. Given the likelihood of vitamin B12 deficiency and/or MSG-poisoning, you need coverage, and soon.

But how do you find the right plan? Don’t fret!

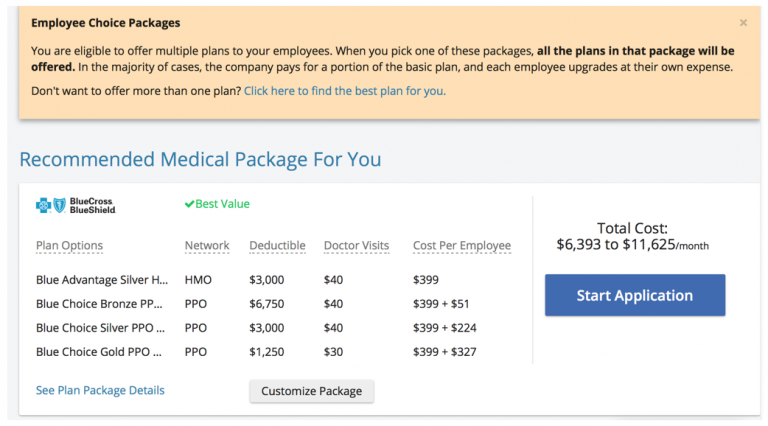

We recently looked at buying insurance for ourselves. There are dozens of plans available in most areas, and it turns out that many are just bad choices – for a given healthcare scenario, some plans are strictly better than others. To understand the whole picture, we built a health insurance cost tool and used it to analyze all plans available to women and men in California in their 20s.

Here’s what we found. (Read on for the gory details – if you’re itching to get back to coding, skip to our summary of results).

◆ Key Insights We Learned

While scrutinizing these plans, we picked up a few useful tips that can make a big difference as you choose health insurance. Our recommendations:

DO:

- If you’re under 26 years of age, get on your parent’s insurance.

Individuals under 26 can be added to their parents medical coverage. Your parents can enroll you once a year during open-enrollment, and you are required to stay on the plan for an entire year – but the incremental cost is typically less than $50. - Put money into an HSA.

We were surprised how few people know that putting money in an HSA can save you 20-30% on healthcare costs (tax deductible, tax-free growth like an IRA). There’s enough to write on this for another article, but one common myth is that if you don’t use the money each year, you lose the funds – this is not true. You can only withdraw funds from the account for health expenses, but the money is always yours. - Get help from Medicaid (starting in 2014).

Thanks to health care reform, starting in 2014, individuals with a yearly income of <$15K are eligible for Medicaid subsidies for health insurance. This means if you’re a founder of a company, you could be eligible for free health insurance. There will also be subsidies available to individuals who earn less than $43K a year.

DON’T:

- Sign up for COBRA coverage.

COBRA coverage costs on average $500/month for individuals. While it usually offers great coverage, there are much most cost-effective plans available directly from the provider. The average insurance premium for an individual in their 20s in San Francisco is $198/month – a full $300/month of savings below COBRA. - Go without coverage.

The cost of even minor medical issues can be extremely expensive. For the uninsured, the average cost of an emergency room visit in San Francisco is $1015 and the average treatment cost for breaking your leg is $1100. Common prescription drugs (like Lipitor, Vicodin) can easily run hundreds of dollars per month. You’ve already taken on risk by doing the startup; without insurance, you’re on the hook for the entire amount.

◆ Our Methodology

Classifying common healthcare needs

To start, we asked a bunch of our startup friends what they wanted out of a health insurance plan. Many just wanted to limit how much they’d pay in case something really bad happened. Others had ongoing medical conditions; they needed coverage for their treatments.

We found that most startup consumers fall into three categories, based on their healthcare needs:

| Category: | Healthcare Needs: |

|---|---|

| Emergencies Only |

|

| Basic Healthcare |

|

| Ongoing Medical Conditions |

|

Modeling costs under all plans

We checked all insurance providers in California (Aetna, Kaiser, etc.) and found 72 plans available to men and women in their 20s. Starting with a list of pricing information for both genders, both tobacco users and non-users, we modeled the following data points for each of the 72 plans:

- Monthly premiums

- Cost of treatment for:

- 1-3 office visits

- Severe cold/bronchitis

- Emergency room visit

- Broken leg

- Type II diabetes

- Heart disease

- Lung cancer

- Maximum out-of-pocket cost per year

Disclaimer: We use the best estimates we have for all prices and costs in our analysis. The final figures may be different when you apply for insurance.

◆ The Analysis

Now that we had a list of all plans, we developed a model for the yearly out-of-pocket cost that you’d end up paying under each of the medical scenarios. Our model takes the detailed plan terms, like deductibles and coinsurances, and calculates how much coverage you get along the way.

Since everybody we talked to wanted protection against run-away medical costs, we sorted the plans by maximum yearly cost. Cutting out poor choices here turns out to be really important – yearly costs range from $4,700 to $46,800! We filtered plans down to the least expensive quartile, leaving only plans with a maximum yearly cost of less than $8,050.

Disclosure: while our site sells health insurance, we analyzed all plans below without any consideration for commissions.

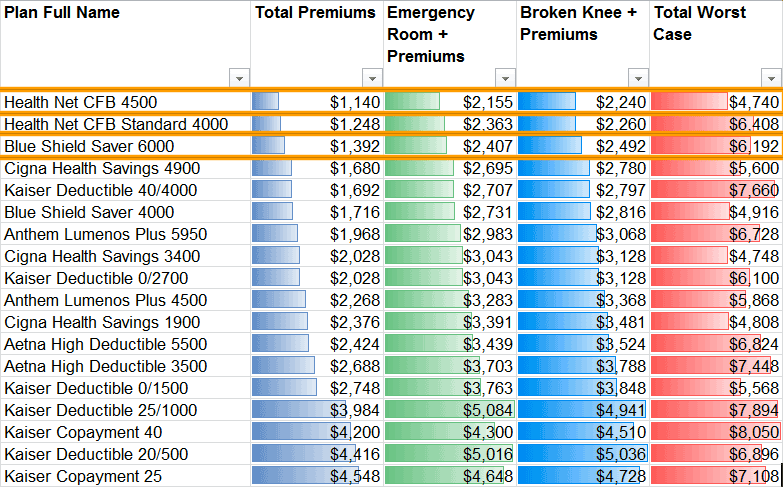

Best plan for “Emergencies Only”

For consumers only want coverage for emergency care, we analyzed yearly premiums, emergency room costs, the cost of treatment for a broken leg, and maximum yearly costs. From the table below, you can see that premiums are the dominant cost for everything but the maximum yearly cost:

The Health Net CFB 4500 is the obvious best choice – it consistently has the lowest cost across all scenarios. While another Health Net plan is second cheapest by total premiums, we chose the Blue Shield Saver 6000 as runner-up instead because it has a lower “worst case” cost AND it’s HSA eligible.

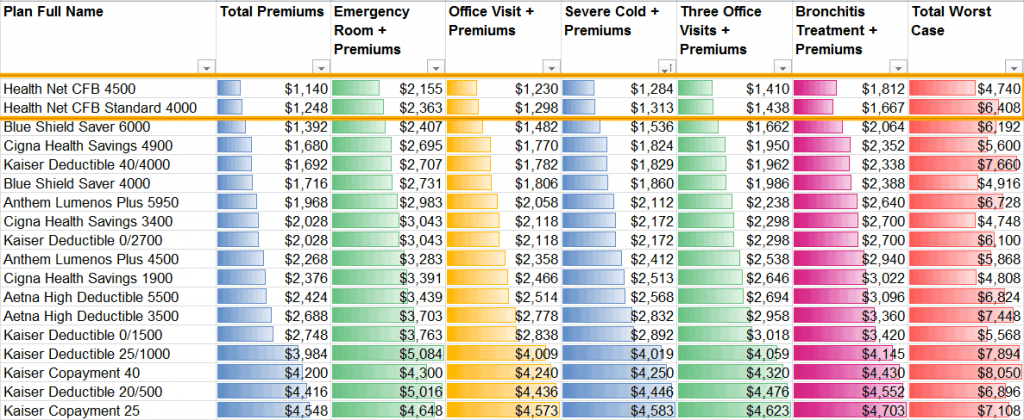

Best plan for “Basic Healthcare”

In the second category, we analyzed each plan for the cost of the most common services and illnesses (office visits, treatment for bronchitis, etc). Again, the Health Net CFB 4500 has the lowest costs for all the ailments listed. This suggests that it scales well from emergency only coverage to typical doctor visits.

Best plan for “Ongoing Medical Conditions”

For the third set of consumers, we analyzed the cost of healthcare for serious conditions and major illnesses – we looked at diabetes, heart disease, and lung cancer. The plans that ranked highest had the lowest total out-of-pocket costs, even though they didn’t have the lowest monthly premiums. The two best plans are both HSA compatible, too.

Given the higher probability of ongoing and potentially expensive medical treatments, these plans are the best fit because they cap overall costs at around $4,800.

◆ Summary

The overall best plan for startup people:

Our Analysis:

This is the overall winner across all of our categories. This plan provides the best balance of 1) low monthly premiums (only $5/mo more than the absolute lowest monthly payment), 2) low worst case costs ($6700 less than the average plan), and competitive costs for a variety of common medical scenarios (emergency room, doctor’s office, etc). We like this plan because it minimizes monthly payments while also minimizing risk (in least expensive 10% for maximum cost).

We’ve heard from customers who have reservations about HealthNet – who are they, and why haven’t I heard of them? Although HealthNet is less well known, our research showed that it has a large doctor network in California (comparable with Kaiser and Aetna) and their PPO insurance is accepted widely. They receive 4/4 stars for Access and Customer Service in Consumer Reports rankings.

(Note – this is the plan that I currently use for my healthcare.)

Runner-up health plans by category:

Runner-up plan for Emergencies Only:

Our Analysis:

The Saver 6000 is a high quality plan if you primarily want health insurance in case of an emergency. While the plan has higher monthly premiums and a higher maximum cost than our top choice, it has a lower maximum and deductible for out-of-network services. If you have a family history of complex medical issues that may need specialists or special treatments, then you may want to consider looking into this plan.

Runner-up plan for Basic Healthcare:

Our Analysis:

Although this plan is not an HSA offering, the low monthly premium and competitive maximum cost make this plan a good option for a lot of startup employees out there. What made this plan really stand out was its low cost for common medical procedures. The first two office visits and the first two specialist visits are covered BEFORE the deductible for only a $50 copay – which is about 50% of the uninsured cost. Moreover, for the “serious cold” scenario this plan performs very well, costing only $65 for treatment including office visits and prescription antibiotics (25% below the median cost of treatment). The overall affordability of common medical procedures establishes this plan as a good option for some people.

Runner-up plan for Ongoing Medical Conditions:

Our Analysis:

The Cigna Health Savings plan is a great option for people with significant medical issues. This could include treatment for diabetes, heart disease, or any cancer – while the Cigna plan has a relatively high monthly payment (higher than 40% of plans), the low deductible, out-of-pocket maximum and overall maximum cost makes it a great choice for people who expect to use a lot of healthcare services. Combined with an HSA, this is definitely the best option if you find yourself at the doctor frequently.