New York Small Business Health Insurance Guide

New York Market Overview

The New York small business health insurance market is a complex one. The New York market is split geographically into several regions, with certain insurance carriers only participating in certain parts of the state (such as upstate vs downstate). For a small business, knowing which insurance carriers offer coverage in the local region is key to finding the right health insurance plan.

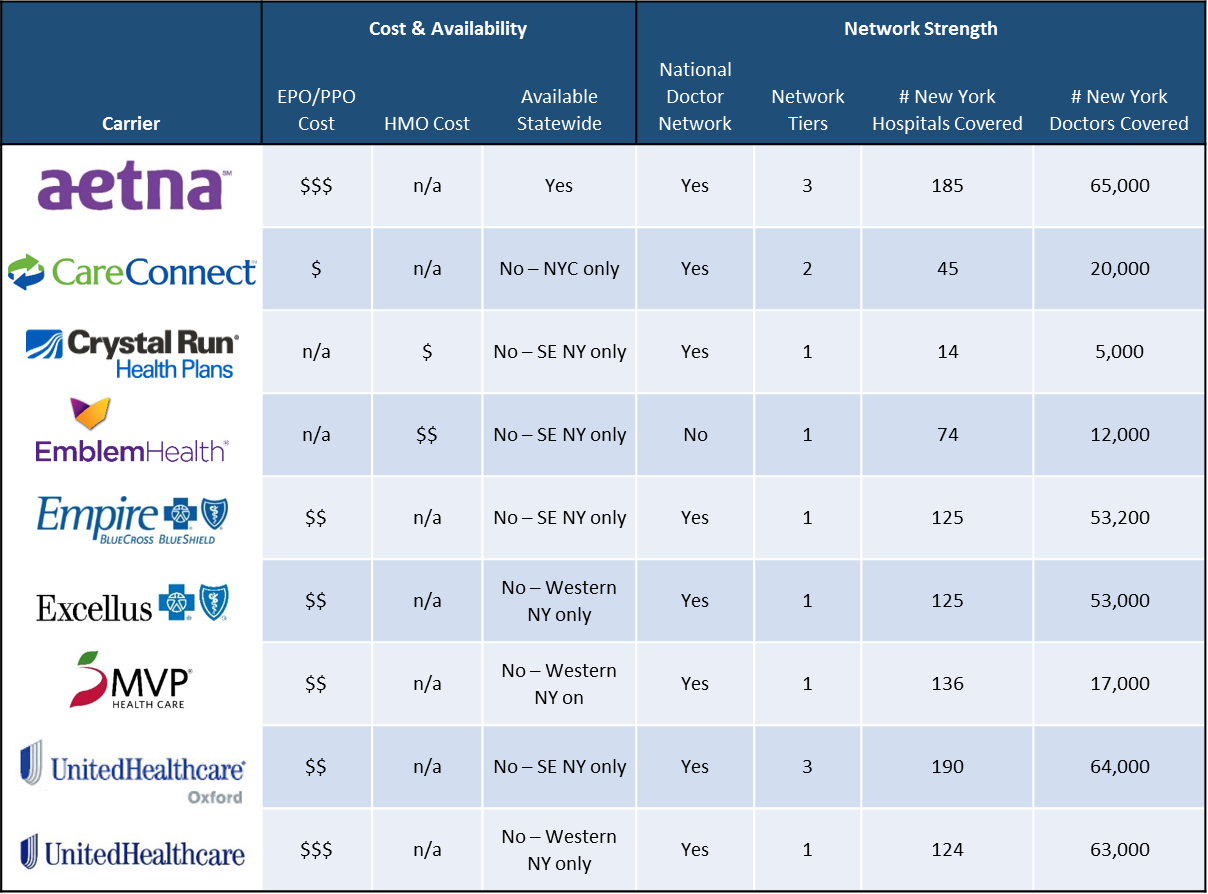

New York Health Insurance Carriers at a Glance

Getting a small business health insurance plan in New York can be a difficult decision given the multitude of options among carriers, networks, and plans. We’ve summarized the various options into a high level overview.

Looking for specific coverage & rate information? See every carrier & plan online at SimplyInsured.com.

Insurance Carrier Overview:

Aetna is a national carrier offering medical, dental, and vision coverage. Aetna offers plans throughout the entire state, with some narrow network plans available specifically to the New York City area.

Aetna offers two main types of networks; (1) a statewide EPO networks and (2) New York City specific networks. Aetna does not offer a PPO network with out-of-network coverage in New York. Companies can offer any number to employees, so plans from different networks can be offered together. (View Aetna plans & rates)

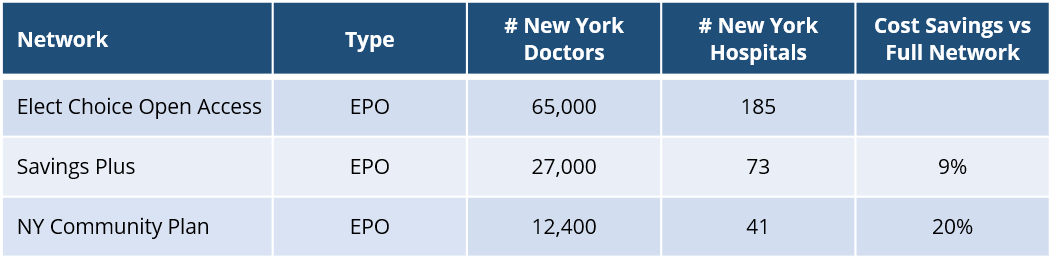

Network Overview

- Elect Choice Open Access EPO: Aetna’s largest network in New York, with access to expansive network of doctors and hospitals. Offers nationwide coverage through Aetna’s national network. One of the largest networks available to small businesses in New York.

- Savings Plus of New York: Narrow EPO network comprised of medical providers with lower negotiated costs to Aetna. Plans are ~9% less expensive than the full network, but also is more restrictive as the plans are only available to employers located southeast New York and NYC.

- NYC Community Plan: Only available to employers located in one of the five boroughs of NYC (Manhattan, Bronx, Queens, Staten Island, and Brooklyn. The NYC Community Plan network is limited primarily to providers in the greater NYC area, but offers very high coverage in return, with no deductible, very low copays, and very low out of pocket maximum. Only a platinum tier option is available, so while the NYC Community Plan is 20% less expensive compared to the full network plan, the plan cost is fairly high.

Insurance Carrier Overview:

CareConnect is a New York insurance carrier, formerly known as North Shore-LIJ. The CareConnect network is much more regional, primarily focused on the NYC metro area and Long Island. CareConnect has one primary network for small businesses, with an option to upgrade to access to a national network through a partnership.

CareConnect is among the lowest cost carriers in the NYC metro, given its smaller network footprint. (View CareConnect plans & rates)

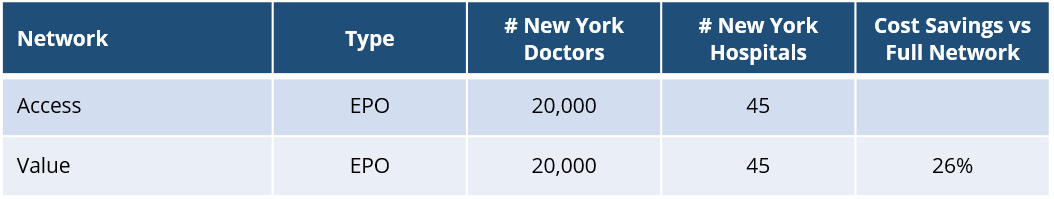

Network Overview

- Access Network: CareConnect’s Access network includes national coverage through MultiPlan, a partner’s national network. Plans on the Access Network are more expensive than only offering the NYC-only Value Network, but lower cost compared to similar plans with national networks on other carriers.

- Value Network: The Value Network is CareConnect’s standard network for small businesses, and among the lowest cost plans available to small businesses. Businesses have access to a strong network within the NYC Metro, but don’t have access to a national network. Value Network plans are 26% less expensive compared to plans on the Access Network.

Insurance Carrier Overview:

Crystal Run is a regional carrier primarily located in Orange and Sullivan Counties in the Mid-Hudson Valley region. Crystal Run primarily operates a HMO network that includes providers in the Crystal Run Health System. EPO plans were previously available, and provided coverage outside of the Core network through partners (statewide New York coverage through MagnaCare and nationwide coverage through FirstHealth).

Given the smaller network footprint, Crystal Run plans are among the least expensive plans available in Orange and Sullivan counties. (View Crystal Run plans & rates)

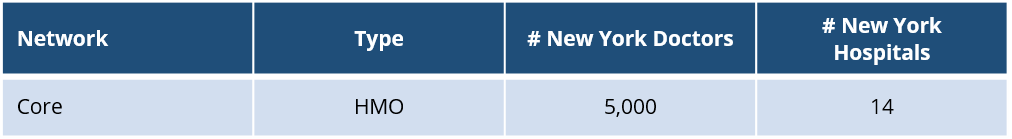

Network Overview

- Core HMO: Consists primarily of physicians and providers in the Crystal Run Healthcare System.

Insurance Carrier Overview:

EmblemHealth is a regional carrier offering medical and dental coverage primarily in the southeast New York area. The coverage map includes 28 counties, from NYC up to certain counties in upstate New York.

EmblemHealth offers 4 HMO plans on its Select Care network to small businesses. EmblemHealth plans are designed primarily to serve the NYC metro area, with access to in-network facilities and doctors only. Coverage on EmblemHealth plans does not include statewide or nationwide coverage, except for emergency care. (View Emblem Health plans & rates)

Network Overview

Insurance Carrier Overview:

Empire Blue Cross Blue Shield is a regional network of Blue Cross Blue Shield plans, offering medical and dental coverage. Empire BCBS serves 28 southeastern and eastern counties of New York. Plans offer statewide coverage on Empire’s Pathway network and national coverage through the Blue Cross Blue Shield BlueCard network. (View Empire BlueCross BlueShield plans & rates)

Network Overview

- Pathway EPO/HMO: Empire BCBS only utilizes one network for all small business plans, the Pathway network. Both the HMO and EPO plans require members to select a Primary Care Physician, but only the HMO plans require a PCP referral to see a specialist.

Insurance Carrier Overview:

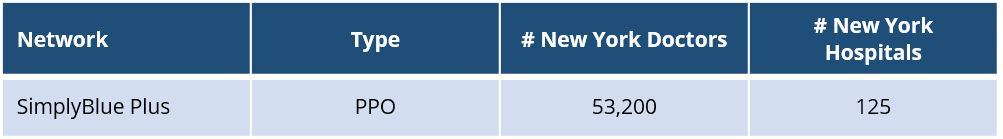

Excellus Blue Cross Blue Shield is a regional network of Blue Cross Blue Shield plans, offering medical and dental coverage. Excellus BCBS serves counties in the Central, Rochester, and Utica region of New York. Plans offer statewide coverage on Excellus’s SimplyBlue Plus network and national coverage through the Blue Cross Blue Shield BlueCard network. (View Excellus BlueCross BlueShield plans & rates)

Network Overview

- SimplyBlue Plus: Excellus BCBS only utilizes one network for all small business plans, the SimplyBlue Plus network. Plans on the SimplyBlue Plus PPO do not require a PCP or referrals, and includes out-of-network coverage.

Insurance Carrier Overview:

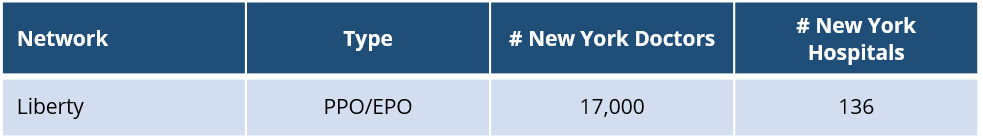

MVP Health Care provides coverage statewide, with the exception of the New York City metro and Long Island. MVP Healthcare primarily operates a EPO/PPO network that includes doctors and hospitals statewide, not as large as the statewide networks available through the larger national carriers.

Given the smaller network footprint, MVP Healthcare plans tend to be less expensive than the national carriers, but more expensive than other narrow network plans. (View MVP Healthcare plans & rates)

Network Overview

- Liberty Network: MVP Healthcare’s Liberty network provides access to doctors statewide.

Insurance Carrier Overview:

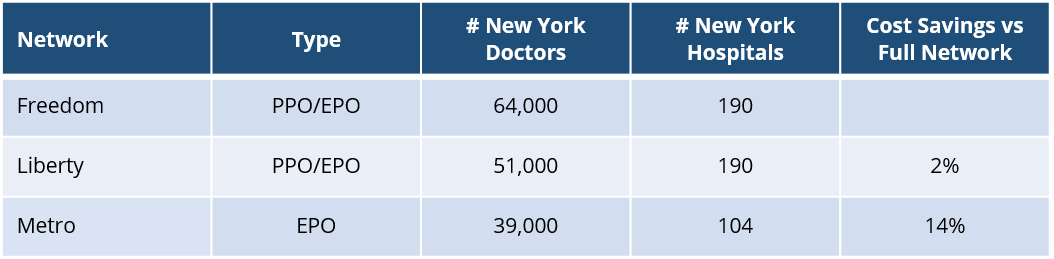

United Healthcare Oxford is part of the United Healthcare, the largest carrier in the country, and offers medical, dental, and vision coverage in most of New York. Oxford plans are available in the NYC Metro and most of the southeast NY region. Oxford is one of the few carriers to provide a PPO plan with out of network access in NYC. Nationwide coverage is provided through United Healthcare’s Choice Plus network.

Oxford PPO plans tend to be more expensive than other carriers given the expansive doctor network, but are typically among the lower cost options for companies looking for higher coverage tiers and a wide network. (View United Healthcare Oxford plans & rates)

Network Overview

- Freedom: Freedom is the largest network available through Oxford, and one of the largest networks available to small businesses in New York. National coverage and coverage outside of NY is through United Healthcare’s Choice Plus network.

- Liberty: Liberty is a narrower network compared to Freedom, but has a 80% overlap in doctors and the same coverage of hospitals as the Freedom network. However, plans are typically only 2% less expensive compared to the Freedom network, so there isn’t a substantial cost savings.

- Metro: Metro is a narrow network available in the NYC metro area, with coverage in both the NYC metro and the NJ tri-state area. Plans on the Metro network includes nationwide coverage on the Choice Plus network when outside of the tri-state area. Metro plans are 14% less expensive compared to the Freedom network, so are a good value for small businesses.

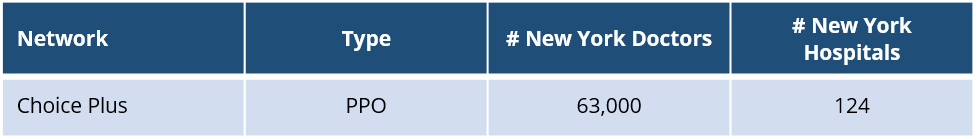

Insurance Carrier Overview:

United Healthcare offers plans in western New York under the UnitedHealthcare brand and through the Choice Plus network. United Healthcare PPO plans provide access to the nationwide United Healthcare network. (View United Healthcare plans & rates)

Network Overview

- Choice Plus PPO: Full PPO network with access to one of the largest network of doctors and hospitals in New York and nationwide coverage through United Healthcare’s national network.