California Small Business Health Insurance Guide

California Market Overview

The California small business health insurance market is one of the most competitive and complex insurance markets in the country. For a small business, there are many health insurance options to choose from – multiple carriers, tiered doctor networks, government exchange vs private market plans, etc. The large number of options in the California market can make looking for the right health insurance plan intimidating, but can also provide substantial savings opportunities by narrowing in on the most appropriate plan for specific needs.

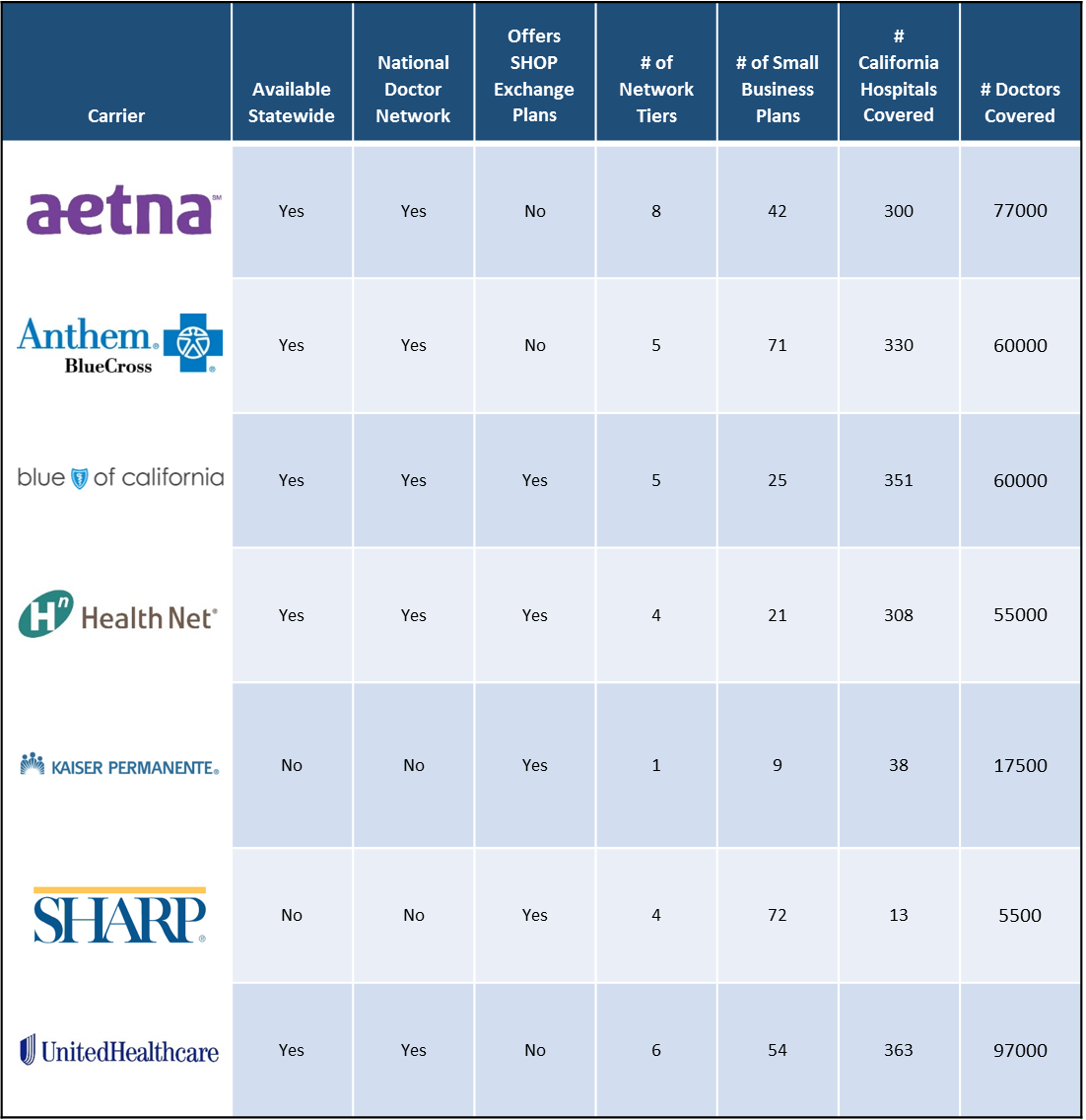

California Health Insurance Carriers at a Glance

Looking for specific coverage & rate information? See every carrier & plan online at SimplyInsured.com.

Insurance Carrier Overview:

Aetna is a national carrier offering medical, dental, and vision coverage. Aetna has a wide variety of HMO and PPO network tiers, ranging from very narrow doctor groups to broad, statewide networks. One key benefit of Aetna is the ability to offer any number of plans and mix & match multiple tiers of coverage and networks to fit your company’s specific needs.

Aetna is currently most competitive in the Southern California market, and has very competitive rates in each tier of HMO plans. (View Aetna plans & rates)

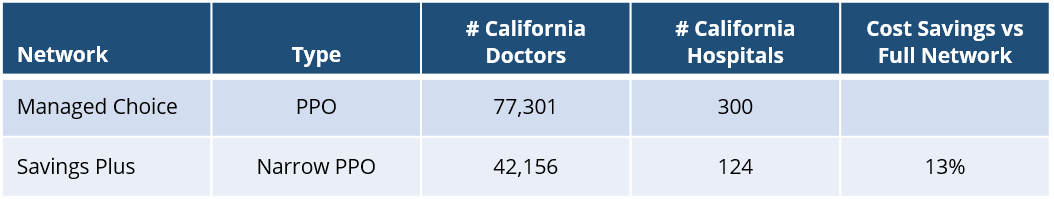

PPO Network Overview

- Managed Choice: Full PPO network with access to very large California doctor network and nationwide coverage through Aetna’s national network.

- Savings Plus: Narrow PPO network comprised of medical providers with lower negotiated costs to Aetna. Plans are ~13% less expensive than the full network. Only available in major metropolitan markets and to in-state employees.

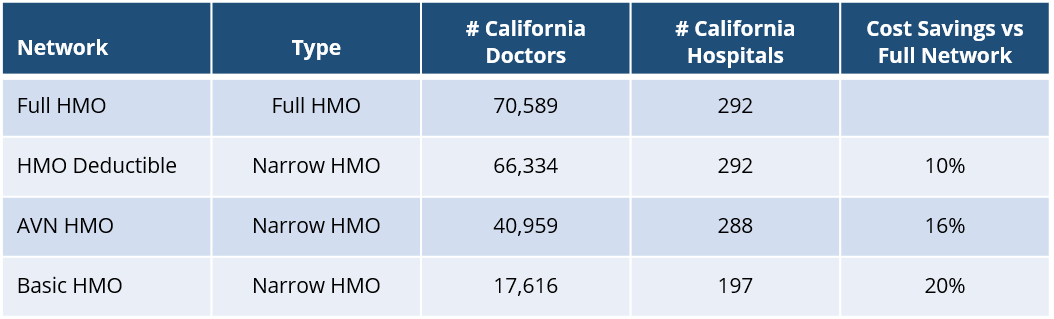

HMO Network Overview

- Full HMO: Full HMO network with comparable network to Aetna’s full PPO, with 90% of doctors and hospitals. Plans are ~10% less expensive than the full PPO plans.

- HMO Deductible: Narrow network HMO that is one of the best value networks on Aetna. Network is 7% smaller but is ~10% less expensive than the full HMO network.

- AVN HMO: Smaller HMO network and ~16% less expensive than full HMO network.

- Basic HMO: Smallest HMO network with only 25% of the network size of full HMO network. Plans are ~20% less expensive than the full HMO network.

Insurance Carrier Overview:

Anthem Blue Cross is part of Wellpoint and a regional network of Blue Cross Blue Shield plans, offering medical, dental, and vision coverage. Anthem has full and narrow network tiers, and allows only one tier to be selected and any number of plans within the tier. PPO plans provide national coverage through the Blue Cross Blue Shield BlueCard network.

Anthem rates are competitive in most areas of California, especially for lower cost PPO plans on the narrow Select network. (View Anthem plans & rates)

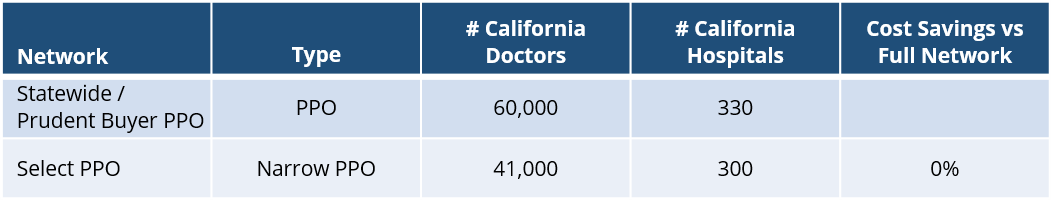

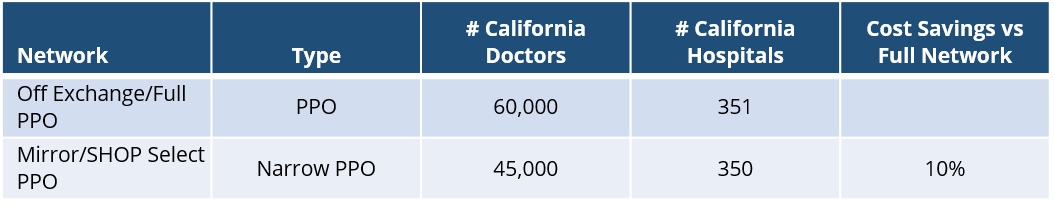

PPO Network Overview

- Statewide/Prudent Buyer PPO: Full PPO network with access to a very large California doctor network and nationwide coverage through the BlueCard network.

- Select PPO: Narrow PPO network comprised of medical providers with lower negotiated costs to Anthem, with 33% small network than the full PPO. The narrow network is only ~6% less expensive than the full PPO, so the full network tends to be the better value. The narrow network also provides nationwide coverage through the BlueCard network.

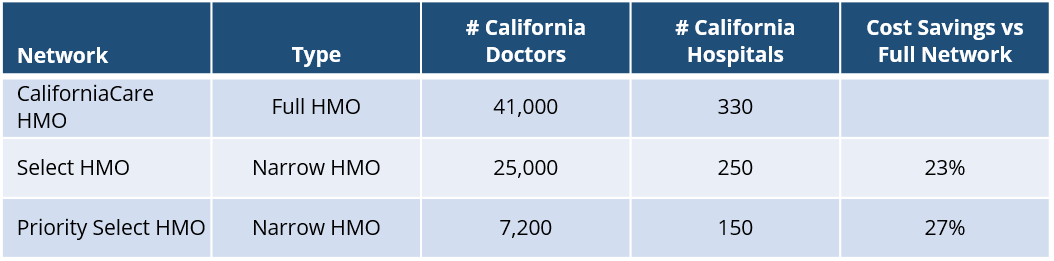

HMO Network Overview

- Full HMO: Full HMO network with ~70% of doctors and hospitals of the full PPO network, and comparable to the Select PPO network. Plans are fairly expensive and typically similar in cost to comparable plans on the full PPO network.

- Select HMO: Narrow network HMO with substantially smaller doctor network than the full HMO. Plans are ~23% less expensive than the full HMO network.

- Priority Select HMO: Ultra-narrow HMO network, with substantially fewer participating doctors and hospitals. The network is strongest in Southern California and is most suited to companies in that region. Plans are ~27% less expensive than the full HMO network.

Insurance Carrier Overview:

Blue Shield of California is a non-profit company offering medical, dental, and vision coverage. Blue Shield has a full and narrow network tiers of HMO and PPO plans, and allows only one tier to be selected and any number of plans within the tier. The narrow network plans are through the Covered California SHOP exchange. Blue Shield PPO plans provide national coverage through the Blue Cross Blue Shield BlueCard network.

Blue Shield plans tend to be more expensive than other carriers in most California markets. Blue Shield is most competitive in Southern California and for high coverage gold/platinum plans. (View Blue Shield plans & rates)

PPO Network Overview

- Off-Exchange/Full PPO: Full PPO network with access to a very large California doctor network and nationwide coverage through the BlueCard network.

- Mirror/SHOP/Select PPO: Narrow PPO network with 75% the network size of the full PPO network. Blue Shield only offers 1 bronze plan on the narrow network and is ~10% less expensive than a comparable bronze plan on the full network.

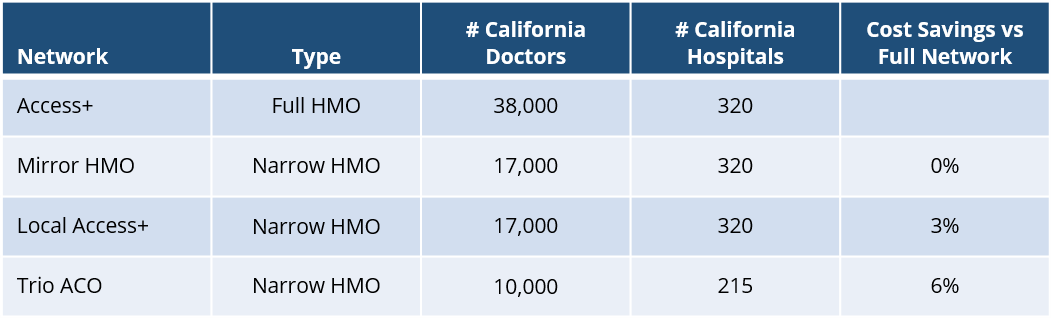

HMO Network Overview

- Access+ HMO: Full HMO network with ~60% of doctors of the full PPO network and similar number of hospitals. Plans are ~5% less expensive than the full PPO plans.

- Mirror HMO: Network used for SHOP exchange plans, and utilizes a mix of the Local Access+ HMO network and the Access+ HMO network. Mirror plans are ~3% less expensive than the full network.

- Local Access+ HMO: Narrow HMO network with ~45% the network size of the full HMO network. Plans are ~6% less expensive than the full network.

- Trio ACO HMO: Limited network HMO plan available in 16 counties organized under an Accountable Care Organization model, or a network of medical providers that share responsibility for coordinating care. Plans are ~8% less expensive than full network.

Insurance Carrier Overview:

HealthNet offers medical, dental, and vision coverage in California, and also has a strong network in Oregon and Arizona. HealthNet PPO plans provide nationwide coverage through the First Health network. HealthNet offers full PPO network, a lower cost EPO network, and several tiers of HMO plans. One key benefit of HealthNet is the ability to offer any number of plans and mix & match multiple tiers of coverage and networks to fit your company’s specific needs. HealthNet also offers some plans through Covered California SHOP exchange.

HealthNet rates tend to be competitive in most California regions, and have very cost effective plans in Northern California and the San Francisco Bay Area. (View HealthNet plans & rates)

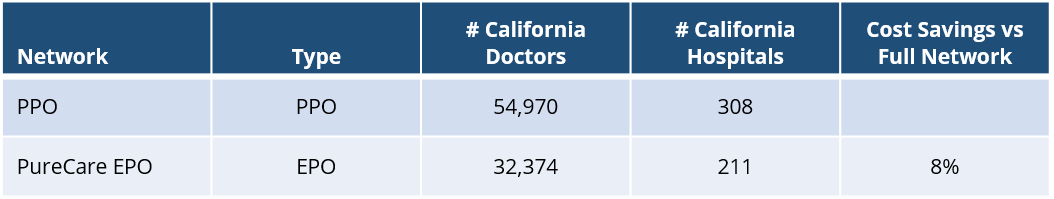

PPO/EPO Network Overview

- PPO: HealthNet offers only one PPO network tier. HealthNet’s network is slightly smaller than other California carriers, but is still very large and covers most California doctors and hospitals. PPO plans provide coverage nationwide through the First Health network.

- PureCare EPO: Narrow network with 60% of doctors and hospitals in the full network and no access to out-of-network coverage. Plans are ~8% less expensive than the full PPO network.

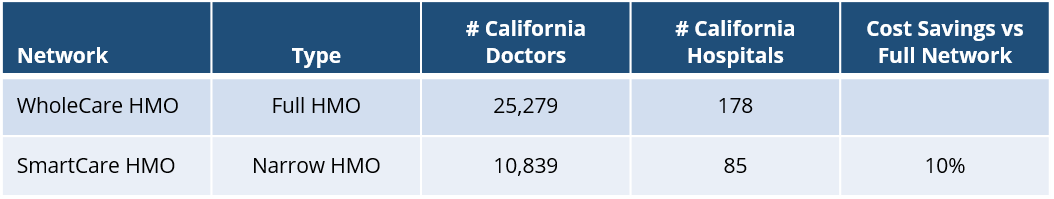

HMO Network Overview

- WholeCare HMO: Full HMO network with ~46% of doctors and ~58% hospitals of the full PPO network. WholeCare network is one of the smaller full HMO networks in comparison to other carriers, though is also typically less expensive. Plans are ~20% less expensive than full PPO plans.

- SmartCare HMO: Narrow HMO with ~42% the network size of the full HMO network. Plans are ~10% less expensive than the full HMO network.

Insurance Carrier Overview:

Kaiser Permanente is non-profit HMO carrier that offers medical and vision coverage in California. Kaiser is unique among California carriers in that it both provides health insurance coverage and medical services through its own network of doctors and hospitals. Kaiser allows any numbers of plans to be offered, and can also be offered in conjunction with plans from another carrier to give employees choice of Kaiser and non-Kaiser options.

Kaiser primarily offers HMO plans, and Kaiser insurance can only be used at Kaiser medical facilities. Out of state employees have the option of enrolling on a PPO plan with access to the Private Healthcare Systems network. Kaiser plans are also available through the Covered California SHOP exchange.

Kaiser serves most areas of California, but has limited networks in certain parts of California given the size of its doctor network. Kaiser plans tend to be the most cost effective plans in most parts of California. (View Kaiser plans & rates)

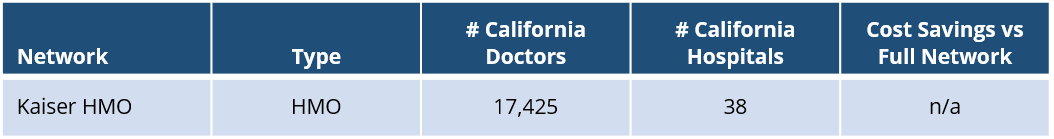

HMO Network Overview

- Kaiser HMO: Kaiser operates a single HMO network in California. Plans directly purchased from Kaiser and the plans from the SHOP exchange provide access to the same network of doctors and hospitals.

Insurance Carrier Overview:

United Healthcare is the largest carrier in the country, and offers medical, dental, and vision coverage in California. United Healthcare PPO plans provide access to the nationwide United Healthcare network. United Healthcare offers two tiers of PPO networks and several tiers of HMO plans, and allows any number of plans to be offered within two portfolio of plans.

United Healthcare PPO plans tend to be more expensive than other carriers given the expansive doctor network, but HMO plans tend to be among the lowest cost options in many parts of California. United Healthcare HMO plans are most cost effective in Southern California. (View United Healthcare plans & rates)

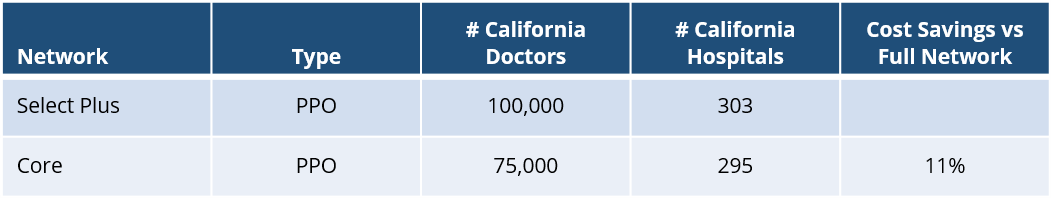

PPO Network Overview

- Select Plus PPO: Full PPO network with access to the largest network of doctors and hospitals in California and nationwide coverage through United Healthcare’s national network.

- Core PPO: Narrow PPO network with ~45% the size of the full PPO network. Plans are ~11% less expensive than the full network.

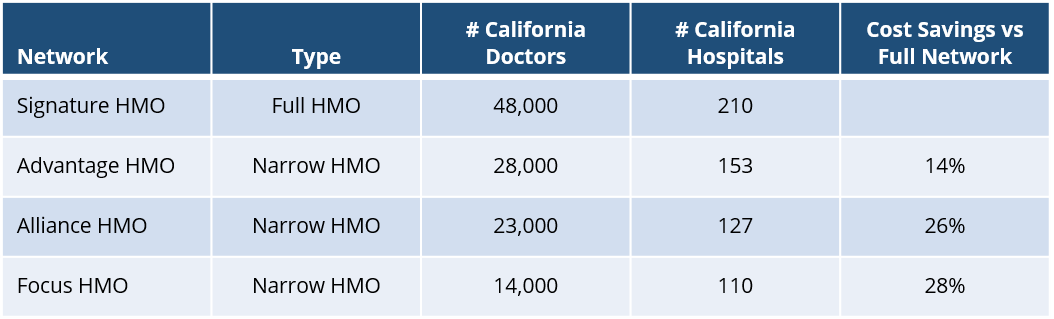

HMO Network Overview

- Signature HMO: Full HMO network with ~52% of doctors and ~65% of hospitals of the full PPO network. Plans are ~10% less expensive than the full PPO plans.

- Advantage HMO: Narrow HMO network with 60% of the doctors of the full HMO network. Plans are ~14% less expensive than the full HMO network.

- Alliance HMO: Very narrow HMO network primarily available in Southern California and with 40% of the doctors of the full HMO network. Plans are ~26% less expensive than the full HMO network.

- Focus HMO: Lmited network HMO available in select California counties. Plan features local providers and community hospitals that provide lower costs, with 25% of the network size of the full HMO network. Plans are ~28% less expensive than the full HMO network.