Virginia Small Business Health Insurance Guide

Virginia Market Overview

The Virginia small business health insurance market is a competitive and complex insurance market. For a small business, there are many health insurance options to choose from – multiple carriers, tiered doctor networks, government exchange vs private market plans, etc. The large number of options in the Virginia market can make looking for the right health insurance plan intimidating, but can also provide substantial savings opportunities by narrowing in on the most appropriate plan for specific needs.

We’ve summarized the various options into a high level set of recommendations, factoring in the options of small business health insurance carriers, networks, and plans available in Virginia.

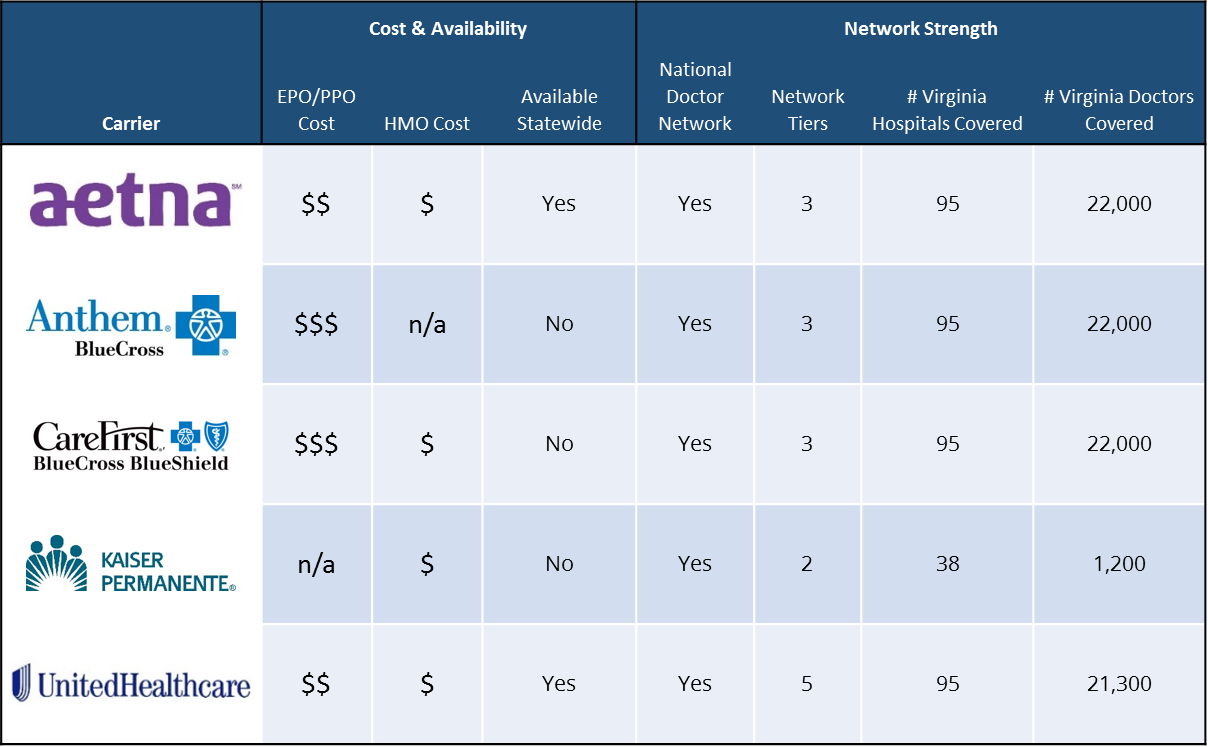

Virginia Health Insurance Carriers at a Glance

Looking for specific coverage & rate information? See every carrier & plan online at SimplyInsured.com.

Insurance Carrier Overview:

Aetna is a national carrier offering medical, dental, and vision coverage. Aetna several networks including PPO and HMO networks options, and allows companies can mix and match up to 5 different plans to offer employees.

Aetna’s full PPO and HMO networks are very broad and includes a large number of hospitals and doctors. (View Aetna plans & rates)

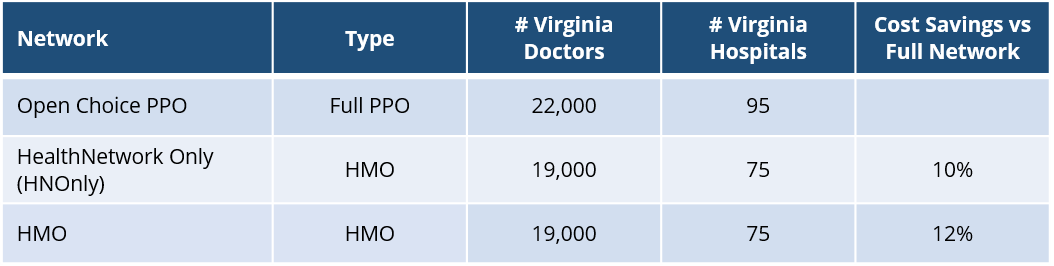

Network Overview

- Open Choice PPO: Aetna’s largest network in Virginia, with access to expansive network of doctors and hospitals. Offers nationwide coverage through Aetna’s national network.

- HealthNetwork Only (HNOnly): Statewide HMO network with a fairly broad network of doctors and hospitals. While a HMO network, HNOnly plans does not require members to select a primary care physician and can utilize specialists without a referral. Plans are ~10% less expensive than the full network.

- HMO: The traditional HMO network utilizes the same doctor network as HNOnly. The HMO network does require members to select a primary care physician and obtain a PCP referral to utilize a specialist. Plans are ~12% less expensive than the full network.

Insurance Carrier Overview:

Anthem Blue Cross Blue Cross is a part of Wellpoint and offers medical, dental, and vision coverage. Anthem’s service area is limited to companies in the western part of Virginia, specifically west of State Route 123.

Anthem plans offer access to a very strong statewide network, and national coverage through the BCBS BlueCard network. (View Anthem Blue Cross plans & rates)

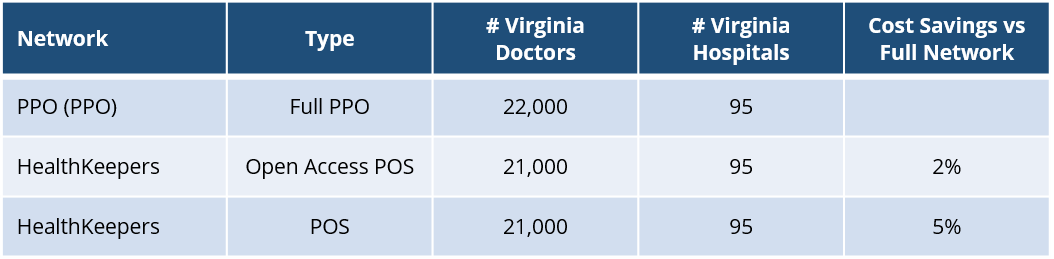

Network Overview

- PPO Network: Full PPO network with access to one of the largest network in Virginia, and nationwide coverage through the BlueCard network. One of the best doctor networks available to small businesses.

- HealthKeepers Open Access POS: The Anthem HealthKeepers point of service network is nearly the same size of the full PPO network, and costs 2% less. HealthKeeper point of service plans require members to select a primary care physician, but referrals are not required to see a specialist.

- HealthKeepers POS: The Anthem HealthKeepers standard point of service network costs 5% less, and also requires members to get a primary care physician referral to see a specialist.

Insurance Carrier Overview:

CareFirst BlueCross Blue Shield serves the northern Virginia / mid-Atlantic region, and offers medical, dental, and vision coverage. CareFirst offers several networks and variants of plans within each network. Companies can choose to multiple offer multiple plans. PPO plans provide national coverage through the Blue Cross Blue Shield BlueCard network. (View CareFirst BlueCross BlueShield plans & rates)

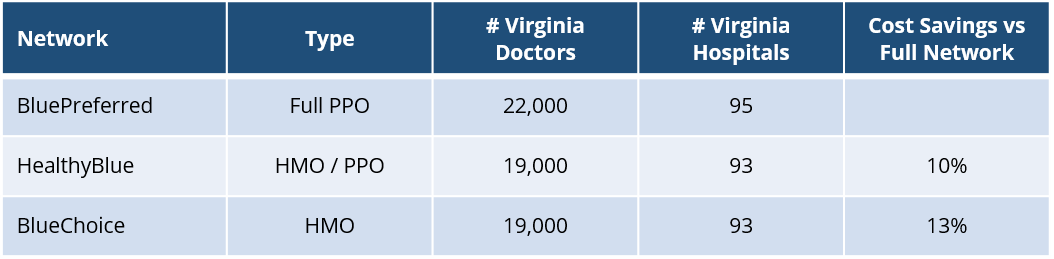

Network Overview

- BluePreferred PPO: Full PPO network with access to a very large network within the mid-Atlantic region. When traveling outside of the mid-Atlantic region and nationally, in-network coverage is provided through the national BlueCard network.

- HealthyBlue: HealthBlue offers both PPO and HMO plan options on the same network. Similar to the BluePreferred network, when traveling outside of the mid-Atlantic region and nationally, in-network coverage is provided through the national BlueCard network. Plans are 10% less expensive compared to the full network. HealthyBlue plans also encourage use of primary care providers and incentives for completing a wellness program.

- BlueChoice: The Blue Choice HMO network utilizes the same network as the overall network, but requires the use of a primary care physician and does not provide out of network coverage. When traveling out of state, only emergency care is covered in-network.

Insurance Carrier Overview:

Kaiser Permanente is non-profit HMO carrier that offers medical coverage in the Virginia, Maryland, and Washington DC area. Kaiser is unique in that it both provides health insurance coverage and medical services through its own network of doctors and hospitals. Kaiser plans are only available to companies located in the Fairfax / mid-Atlantic region of Virginia.

Kaiser primarily offers HMO plans, and plans on the Signature network can only utilize Kaiser facilities. Out of state employees have the option of enrolling on a PPO plan with access to the Private Healthcare Systems network. Kaiser plans are also available through the Covered California SHOP exchange. (View Kaiser Permanente plans & rates)

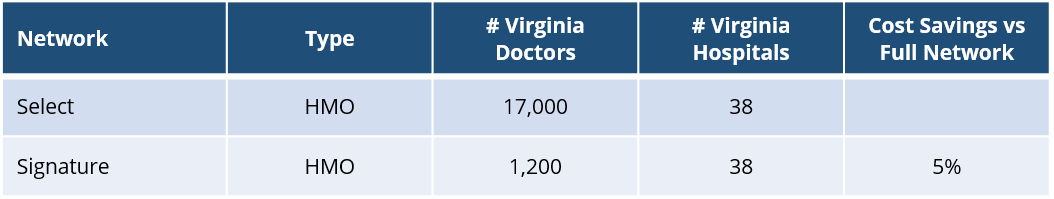

Network Overview

- Select HMO Network: The Kaiser Select network is the widest network available, giving access to both the Kaiser Permanente network of physicians as well as community physicians outside of the Kaiser network.

- Signature HMO Network: The Signature HMO network includes Kaiser’s mid-Atlantic footprint, which consists of ~1200 physicians and ~38 hospital locations.

Insurance Carrier Overview:

United Healthcare is the largest carrier in the country, and offers medical, dental, and vision coverage in Virginia. United Healthcare PPO plans provide access to the nationwide United Healthcare network. United Healthcare offers two tiers of PPO networks and a HMO network, and allows any number of plans to be offered. (View United Healthcare plans & rates)

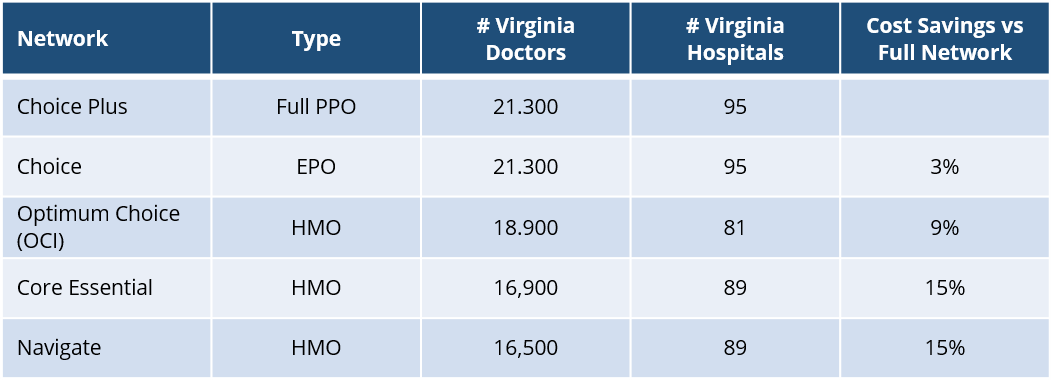

Network Overview

- Choice Plus PPO: Full PPO network with access to one of the largest network of doctors and hospitals in Virginia and nationwide coverage through United Healthcare’s national network.

- Choice EPO: The Choice EPO network uses the same network as the Choice Plus network, but does not include out-of-network coverage. Choice EPO plans are ~3% less expensive than the full PPO version.

- OCI HMO: Narrow network PPO with 85% of the doctors in the full network. Core PPOs have access to coverage nationally as well. Core PPO plans are ~16% less expensive than the full PPO version.

- Core Essential HMO: Narrow network PPO with 85% of the doctors in the full network. Core PPOs have access to coverage nationally as well. Core PPO plans are ~16% less expensive than the full PPO version.

- Navigate HMO: Fairly large HMO network with 50% of the doctors and 70% of the hospitals of the PPO network. One of the largest HMO networks in Virginia, and plans are ~23% less expensive than the full PPO.