Texas Small Business Health Insurance Guide

Texas Market Overview

The Texas small business health insurance market is a competitive and complex insurance market. For a small business, there are many health insurance options to choose from – multiple carriers, tiered doctor networks, government exchange vs private market plans, etc. The doctor network tiers is particularly important for a small business to review, as many carriers offer regional-specific plans that only includes doctors and hospitals in that region (e.g. Houston-only, Dallas-only, etc).

To help make the process a bit easier, we’ve summarized the various options into a high level overview.

Texas Health Insurance Carriers at a Glance

Looking for specific coverage & rate information? See every carrier & plan online at SimplyInsured.com.

Insurance Carrier Overview:

Aetna is a national carrier offering medical, dental, and vision coverage. Aetna offers two main types of networks; (1) statewide EPO and HMO networks and (2) region specific networks called Aetna Whole Health. However, Aetna does not offer a PPO network with out-of-network coverage. Companies can mix and match up to 5 different plans to offer employees. (View Aetna plans & rates)

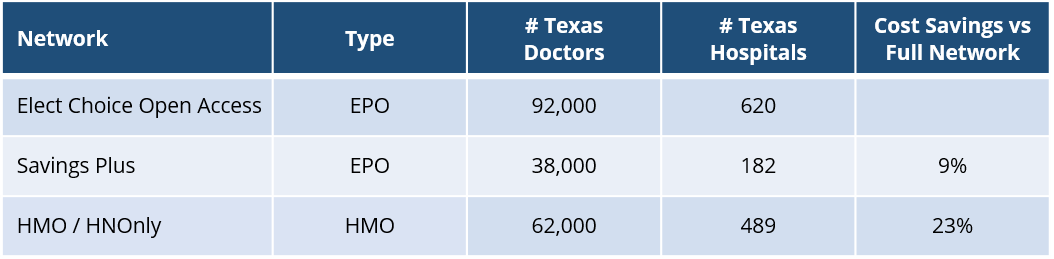

Statewide Network Overview

- Elect Choice Open Access EPO: Aetna’s largest network in Texas, with access to expansive network of doctors and hospitals. Offers nationwide coverage through Aetna’s national network.

- Savings Plus of Texas: Narrow EPO network comprised of medical providers with lower negotiated costs to Aetna. Plans are ~9% less expensive than the full network, but also is more restrictive as the plans are only available in major metropolitan markets and to in-state employees.

- HMO / HNOnly: Statewide HMO network with fairly large network of doctors and hospitals, and substantially less expensive compared to full EPO network.

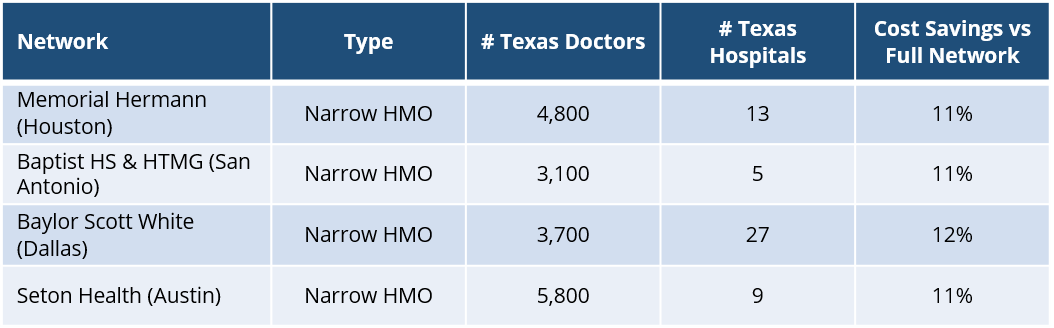

Aetna Whole Health (AWH) Regional HMO Network Overview

- Aetna Whole Health Regional HMOs provide access to doctors and hospitals associated with specific medical systems in each major city (Houston, Dallas, San Antonio, and Austin).

- oPlans are typically 11-12% less expensive compared to the full network

- oHowever, these networks are region-specific, and do not provide statewide or nationwide coverage, except for emergency medical care

Insurance Carrier Overview:

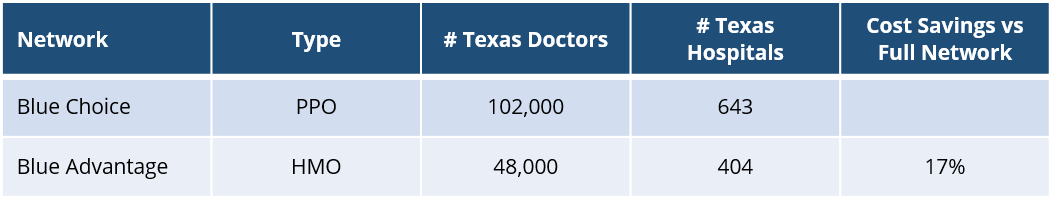

Blue Cross and Blue Shield of Texas is part of the Health Care Service Corporation, and is a regional network of Blue Cross Blue Shield plans, offering medical and dental coverage. BCBS TX offers only 2 tiers of networks, PPO and HMO. Companies can choose to offer up to 6 plans, 3 PPO plans and 3 HMO plans. PPO plans provide national coverage through the Blue Cross Blue Shield BlueCard network.

BCBS TX rates are among the most competitive in most areas of Texas. BCBS TX HMO plans are the lowest cost plans available in most of parts of Texas. (View BlueCross BlueShield of Texas plans & rates)

Network Overview

- Blue Choice PPO: Full PPO network with access to the largest network in Texas, and nationwide coverage through the BlueCard network. The best doctor network available to small businesses.

- Blue Advantage HMO: The HMO network includes ~50% of the doctors and ~63% of the hospitals on the PPO network.

Insurance Carrier Overview:

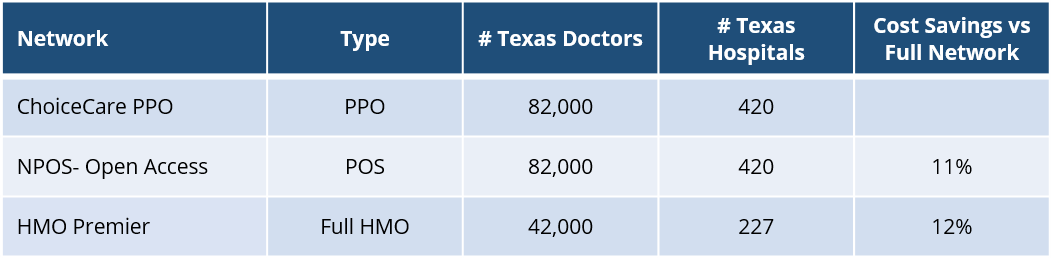

Humana offers a variety of medical, dental, and vision coverage. Humana offers two main types of networks; (1) statewide PPO and HMO networks and (2) region specific HMO networks. Humana’s full PPO plans have an expansive network of doctors and hospitals.

Humana is also very small business friendly, and covers many classes of small businesses that other insurance carriers do not, such owner-only companies and husband/wife-only companies. (View Humana plans & rates)

Statewide Network Overview

- ChoiceCare PPO: Full PPO network with access to a very large Texas doctor network and nationwide coverage on Humana’s national network.

- NPOS – Open Access: Similar to the ChoiceCare PPO network in breadth, however the NPOS plan separates physicians into preferred vs non-preferred tiers. Going to physicians in the preferred tier will result in lower bills than a physician on the non-preferred tier. Plans on this network are ~11% less expensive than the full network.

- HMO Premier: Humana’s full HMO network is comparable in size to the BCBS HMO, however is similar in cost to the NPOS network.

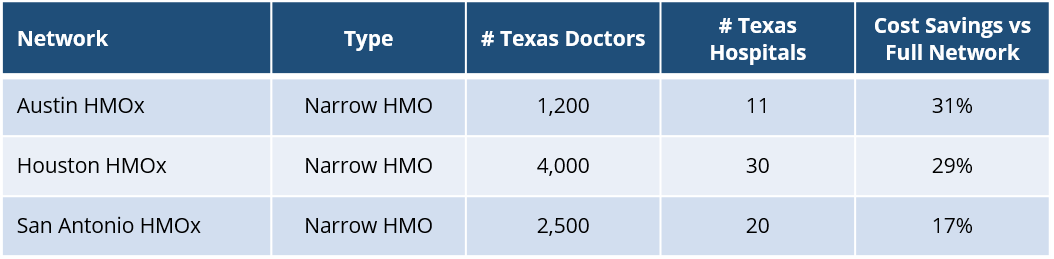

Regional HMO Network Overview

- Humana has three region specific HMO plans for Austin, Houston, and San Antonio.

- Only companies located in-network can get the plans, and only have access to doctors and hospitals within the regional network, and do not provide statewide or nationwide coverage, except for emergency medical care.

- The rates for the narrow network plans can be up to ~30% less than the full network, so these plans can worthwhile for companies on a budget.

Insurance Carrier Overview:

Memorial Hermann Health Solutions is a health insurance plan offered through Memorial Hermann Health System. Memorial Hermann plans are designed primarily to serve the Houston area, with access Memorial Hermann’s facilities and doctors only. Coverage on Memorial Hermann plans does not include statewide or nationwide coverage, except for emergency care.

Memorial Hermann offers both a PPO and HMO network, with access to its hospitals and physician network in the greater Houston metro. (View Memorial Hermann plans & rates)

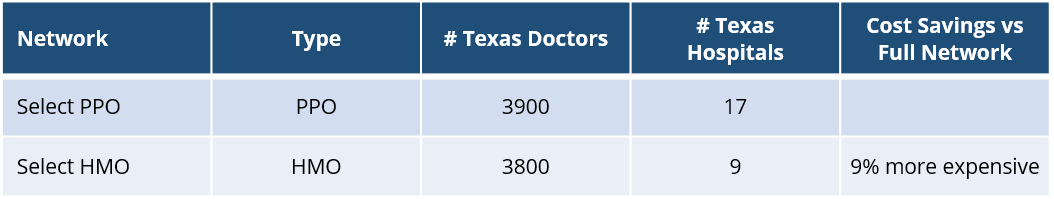

Network Overview

- Select PPO: PPO network with access to most of the doctors and all of the hospitals within the Memorial Hermann Health System. The plan also provides for out-of-network coverage, so patients can get care outside of the Memorial Hermann network if necessary.

- Select HMO: The Select HMO network has nearly the doctor network as the PPO plans, but restricts the number of hospitals that can be utilized in-network. The HMO plans is actually more expensive compared to the PPO plans, so does not represent a good value.

Insurance Carrier Overview:

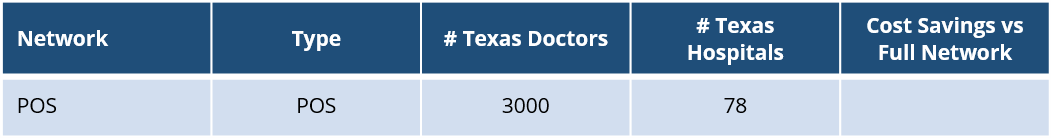

The Scott & White Health Plan is a non-profit insurance carrier part of BaylorScott&White Health, formed through a combination with the Baylor Health Care System. The Scott & White Health Plan provides coverage primarily on the Baylor Health Care System in Dallas, but also includes some providers in other parts of Texas. (View Scott & White plans & rates)

Network Overview

- POS: The network includes the Baylor Health Care System, as well as access to hospitals in other areas of Texas.

Insurance Carrier Overview:

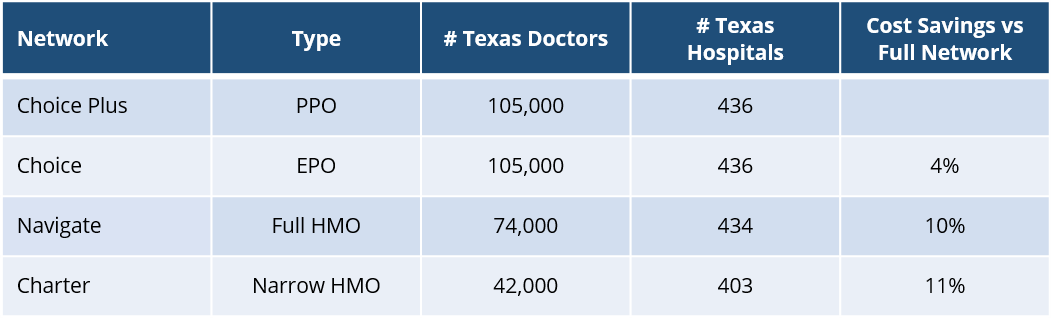

United Healthcare is the largest carrier in the country, and offers medical, dental, and vision coverage in Texas. United Healthcare PPO plans provide access to the nationwide United Healthcare network. United Healthcare offers a combination of PPO, EPO, and two tiers of HMO plans, and allows any number of plans to be offered.

United Healthcare PPO plans tend to be more expensive than other carriers given the expansive doctor network, but are typically among the lower cost options for companies looking for higher coverage tiers and a wide network. (View United Healthcare plans & rates)

Network Overview

- Choice Plus PPO: Full PPO network with access to one of the largest network of doctors and hospitals in Texas and nationwide coverage through United Healthcare’s national network.

- Choice EPO: Access to the same network of doctors and hospitals as Choice Plus, but plans do not include out of network coverage. Choice EPO plans are ~4% less expensive than the full PPO version.

- Navigate HMO: Fairly large HMO network with 75% of the doctors and 98% of the hospitals of the PPO network. One of the larger HMO networks in Texas, though plans are only ~10% less expensive than the full PPO.

- Charter HMO: Narrow HMO network with ~40% the doctors of the full PPO network, though nearly the same number of hospitals. Charter plans are about the same cost as plans on the Navigate network, so are not a substantially better value.